Land prices in Nairobi’s satellite towns are showing signs of fatigue, as tighter household budgets and a slowdown in self-building activity among middle-income buyers dampen demand and stall growth.

According to the latest HassConsult Land Price Index, land values in 14 satellite towns rose by just 0.84 per cent in the third quarter of 2025, this marks the slowest annual growth rate in five years at 6.6 per cent.

The average cost per acre stood at Sh32.3 million, significantly lower than the Sh223.9 million recorded in Nairobi’s suburbs.

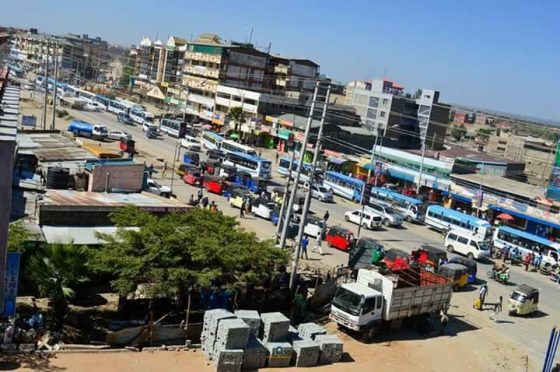

The report attributes the cooling market to the retreat of individual homebuilders, who have traditionally driven demand in areas like Kitengela, Kiserian, and Athi River. “These towns have long been the go-to zones for middle-class families building homes in phases,” said Sakina Hassanali, Co-CEO and Creative Director at HassConsult. “But constrained finances are making it harder for buyers to cross the initial threshold of land acquisition.”

ALSO READ:

Kajiado Gears Up for the 3rd Edition of Maa Cultural Festival At Amboseli

While land in satellite towns remains relatively affordable, the pace of appreciation has slowed, especially in areas reliant on individual buyers. In contrast, towns with active developer interest continue to post stronger gains. Mlolongo led quarterly growth at 3.45 per cent, followed by Limuru and Kiserian. Juja recorded the highest annual increase at 14.85 per cent, while Kiambu and Ngong saw declines of 1.94 per cent.

Within Nairobi, land prices fared slightly better, rising by 1.22 per cent in the third quarter and 6.27 per cent year-on-year. The uptick was driven by redevelopment and mixed-use projects in prime suburbs. Spring Valley emerged as the fastest-growing area, with land prices climbing 3.6 per cent during the quarter and 13.3 per cent over the year, as developers repurpose large residential plots for multi-use developments.

Other suburbs such as Karen, Lang’ata, and Gigiri posted steady gains, reflecting sustained demand for both residential and commercial spaces. However, upscale areas like Muthaiga and Ridgeways experienced minor dips, attributed to planning restrictions and limited public transport access, factors that discourage high-density development.

YOU MAY HAVE MISSED:

“Only zones with strong developer interest are seeing meaningful price growth,” Hassanali noted, highlighting mixed-use projects as a key driver of urban land value.

Despite the current slowdown, long-term data shows land remains a resilient investment. Since 2007, land in Nairobi suburbs has appreciated 7.4 times, while satellite towns have surged 13.23 times. HassConsult estimates that Sh1 million invested in satellite town land in 2007 would now be worth Sh13.23 million, compared to Sh7.4 million in Nairobi suburbs.

The report concludes that entry-level opportunities still exist in towns like Kiserian (Sh13.4 million per acre) and Kitengela (Sh18.8 million per acre), but the market is increasingly shifting toward institutional and commercial developers.

Analysts expect this trend to persist until household incomes recover and self-building resumes.

By Masaki Enock